http://seekingalpha.com/article/260900-the-impending-collapse-of-the-gold-bubble

By analyzing the reasons behind gold’s surge; presenting the relevant fundamental stories, projections, and catalysts; studying the price action, supply and demand factors, and technical levels; and pointing out the extreme and very unsettling psychological forces currently involved in the gold theme – we will explain why the herd-like behavior and highly speculative participation in Gold is pointing to a huge bubble that poses severe risks and may soon collapse.

With global crises, currency devaluations, stagnant recoveries, and a looming threat of war, many funds and investors have flocked to gold as a diversification tool, protection from inflation, and even investment. And with prices up nearly 500 percent in less than 10 years, many still see more upside for this historic store of value. But with the most prominent banks, research firms, gold mining companies' CEOs, and investment legends predicting gold prices to reach anywhere from $1,000 to $15,000, who do we listen to? And can we really be sure these aren't extremely optimistic forecasts that will never be realized?

It is true that many of the most well-known individuals strongly believe in the continuation of the enormous gold bull market. It is also true that gold has been of tremendous interest to investors and speculators worldwide due to its importance as a "fear hedge," store of value, protection against currency devaluation, and "tangible" wealth. But after an historically steep 10-year rise and domination of news and media headlines and investor attention for at least a year now, are most of gold's fundamental reasons already factored into the price?

Frankly, this gold bubble - which will eventually pop - has been dragging on for longer than I expected.It is completely possible that we will see an additional steep rise if global fears escalate. It is also possible that gold prices will soar for a short period, marking a "blowoff top" - which would also signal the beginning of gold's collapse. But the major issue regarding gold is the risk to average investors who have bought gold recently in hopes of riding along with the rest of the crowd. Not only will many latecomers suffer major losses, but if they have invested in gold in the form of coins or physical gold they will be stuck with an asset plunging in value and hard to dispose of for a reasonable loss.

I am not arguing with the underlying reasons that make gold attractive. Gold’s inherent value is understandable. As I’ve mentioned in previous articles ("Gold Bubble: Final Warning?"), the rapid price increase in gold over the past few years is due to mounting fears over currency, poor investment alternatives, and the lack of stability in just about anything else – among other things.

I completely understand the bullish case for gold: It’s a "tangible" store of value, it can act as a hedge for currency risk, demand is expected to continue to grow, etc. What I don’t agree with, however, is that the current price of gold is justified. Sure, demand has increased, uncertainty continues, and the threat of financial collapse still lingers over our heads. But at what point have we sacrificed our rational thinking by skyrocketing gold prices just to own a "tangible" asset? Believing that gold will "always retain its value" is a complete misconception – yes, gold will always be valuable; but its actual value relies on how much people are willing to pay for it. Gold would still be valuable at $800 an ounce. But if you buy it at $1400 and the price drops to $800 because people start to realize they have become a little too exuberant, you still lose a lot of money. Gold is therefore not a screaming buy as many believe. Instead, I think that over-speculation, extreme expectations, faulty arguments, and massive publicity make investing in gold much riskier than many are willing to accept.

Why gold is in a bubble:

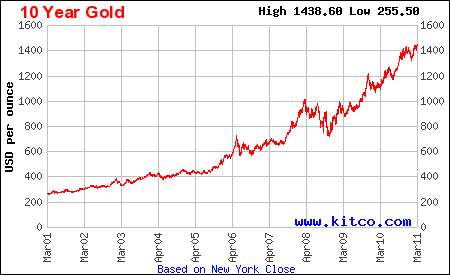

1. Rapid Price Run-Up

Gold prices have exploded upwards from near $250/oz to above $1400/oz in 10 years! For an asset that has been the main source of value for thousands of years and throughout the history of civilization, such a massive move requires a radical shift in circumstances. We do potentially have that radical shift underway, but it’s hard to believe that the chaos of our current state of affairs is any more extreme than the massive upheavals that have been encountered throughout history – such as World War I or II, the Great Depression, or any other major financial panic.

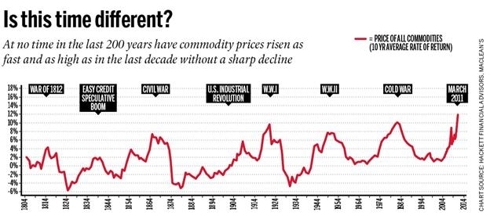

And if we compare the current commodity price surge to the tremendous moves over the past 200 years, can we really say with certainty that this time will be different? Every other time commodity prices have risen this quickly, they have seen sharp declines.

2. Information Cascade

"Bull markets are born on skepticism, mature on optimism, and die on euphoria." -John Templeton

For a speculative bubble to form and expand, a few core requirements must be met. First, there must exist a small number of individuals or investors who profit from a specific investment. Second, a second wave of investors must see the profits made by the first group and invest in the same asset in hopes of realizing profits similar to group one. The longer the speculative bubble lasts, the higher the number of waves or groups of investors that will participate. Most importantly, however, is that each successive wave of investors sees smaller and smaller profits and is at more risk than the group before it. In other words, the first ones to hear about or invest in this investment theme were the true leaders whose potentially big profits convinced many investors to follow in their footsteps and attempt to repeat their success; but the attempt to repeat others’ previous success is often met with failure, and those individuals who jump on the train too late can suffer huge losses.

It is therefore the transfer of investing enthusiasm from one individual to the next that makes the bubble develop and expand. And the expansion is accomplished through what has been termed an "information cascade": as stories of profits proliferate via personal accounts or media coverage, information regarding the investment theme is transferred; and as that information transfer continues and grows, it sparks a lot of interest and enthusiasm among new potential investors – thereby expanding the bubble.

So how does this apply to Gold?

Since the bull market in gold has lasted for approximately 10 years now, there has been plenty of time for success stories of the initial investors in gold to proliferate throughout the rest of the investing world. After a period of relative success, the next wave of investors joined the gold bandwagon. Then came the introduction of gold ETFs, which made investing in gold easier and more accessible to the average investor. With the addition of factors such as financial turmoil, plunging stock prices, and increasing media attention, gold has been able to continually expand as a "surefire" investment theme. But with the possibility that investor and media enthusiasm is at an extreme, the gold bubble could be reaching its peak.

Here’s how Carl Futia, self-described contrarian, explains the influence of first-investor success stories:

"This is a nearly universal characteristic of investment crowds. Any social group’s growth is fed by the success of its founding members. An investment crowd’s growth is stimulated by the financial success of its early adherents. They have gotten rich from a dramatic upward move in the price of some asset ("The Art of Contrarian Trading," 24)."

It is exactly these success stories and human greed, in attempting to copy others’ success, that keep these speculative bubbles going:

"Crowds develop and grow during a communication process called an information cascade. During an information cascade the print and electronic media focus public attention on recent, dramatic movements in markets and the associated profits and losses of investors. This in turn encourages people to put aside their natural skepticism and adopt the investment theme the media are highlighting. As the investment crowd thus grows larger, it pushes the market even further away from fair value and toward a substantial valuation mistake (ibid. xii-xiii)."

Moreover, it is the big price change in the asset that the crowd then relies on as proof of further gains. And although betting on future price increases based on large run-ups that have already occurred is counter-intuitive and risky, the speculative bubble crowd actually uses these faulty arguments as proof of its correctness.

The crowd then continues to grow as institutional investors, investment gurus, and average investors join. The continuous coverage of success stories, hopes of extreme future profits, and the comfort of being part of an investment crowd with numerous and prominent members, all contribute to these investors’ beliefs that their investments are sound and that their arguments are well-supported.

But the crowd cannot be right forever. At some point there just aren’t any profits to be made because everyone has attempted to profit from the same thing. The arguments that were made in support of the investment may have been based on true statements and forecasts, but the high prices to which the underlying asset has been pushed are no longer justified. In other words, investors were correct in that what they invested in should rise; but the excitement and frenzy over their investments pushed prices to extremes – which were no longer justified by their original arguments in support of those investments.

It is at this time that the speculative bubble is at risk of deflating. So long as the crowd’s success continues, and money is still being made, the bubble can continue to grow by attracting new investors. But once profits begin to wane or there are few if any investors left to join the crowd, the bubble begins to implode. Not much different than a Ponzi scheme, the end of new-investor participation marks the end of the run; and it is many of the last investors to get in that suffer the greatest losses.

The collapse of the speculative bubble picks up steam on the way down just as the bubble picked up steam on its way up:

"Because an information cascade is so fragile, the growth of an investment crowd is likely to halt as soon as the above-average returns to its investment theme fail to materialize. This will happen as a natural consequence of the significant divergence of the market price from fair value that has resulted from the crowd’s investment activities. And as soon as the crowd’s growth stops, there will then be a trickle of members who lose faith in the crowd’s theme. As they leave the crowd, the market price will slowly begin to drift back toward fair value. At that point the information cascade that built the crowd will begin to run in reverse and the trickle of disillusioned members will become a flood (ibid. 41)."

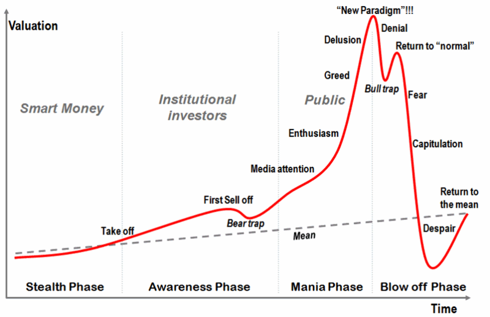

So where are we now in the life of the bubble?

We have undoubtedly passed the "stealth" phase in which the first smart-money investors bought gold around ten years ago. We have also passed the "awareness" phase, in which institutional investors jumped on board before the majority of the public; the introduction of the gold ETFs approximately five years ago probably took place during this phase. We then entered the "mania" phase, in which increasing media attention, public enthusiasm, and – likely - delusion have taken place. There is still a possibility of a rapid "blow-off" phase where prices will shoot up for a short period, tricking the final investors to get in before the bubble ultimately collapses. It is still unsure if the top has been reached; but caution is highly warranted if we currently are nearing the peak.

3. Media Frenzy

There is no doubt that gold has become the focus of much attention over the past year or two: the price has soared, it has become the number one source of "protection" from currency devaluations and economic turmoil, and it is the center of discussion in much of the financial media.

And it is by following the exuberant media coverage of gold that we can better understand the psychology and speculative behavior of the crowd:

"Because the print and electronic media are midwives to the birth of investment crowds, we have the opportunity to watch crowds develop from toddlers to mature adults just by monitoring media content (ibid. 73)."

But why is that a bad thing?

TV Signals Top? Gold vs. Housing

"Even more significant are new TV series that appear just as an associated crowd is about to begin its disintegration process (ibid. 75)."

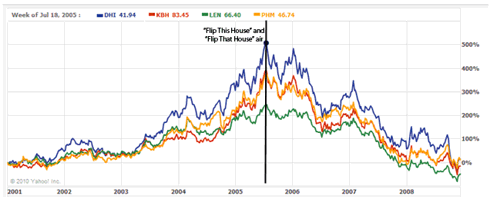

Huge publicity may signal the top. If widespread media coverage is a sign of investment saturation and the peak of popularity, gold may have already peaked. Gold has made the front page of the Wall Street Journal and has been the subject of a popular TV show entitled "Gold Rush: Alaska." As I mentioned in "Is TV Signaling a Top in Gold?", the housing bubble peaked and began its collapse at the exact time that TV shows were portraying the "house-flipping" process to the masses.

If "Flip This House" and "Flip That House" signaled the peak of the speculative bubble-hunting in the housing market, "Gold Rush Alaska" may prove to do the same for the gold bubble, which may have started for the right fundamental reasons and which has made a considerable profit for a numerous bunch, but which may ultimately end in disaster for those who have joined the party too late.

Wall Street Journal Warning Signal

In addition to TV media, the print media has embraced the gold theme as well. And with the Wall Street Journal displaying gold as the cover story in late 2010, the end may be near.

"In the early 1970s Paul Macrae Montgomery observed that when Time magazine had a cover story about a prominent business personality, about the stock market, or about some other finance-related matter, one could often infer that an important move in the markets was imminent, a move that was likely to be in the direction opposite to what the cover suggested. Optimistic covers led to unexpected drops in prices, while pessimistic covers had the opposite effect (ibid. 92)."

Though the study by Montgomery involved Time magazine, the principle could be applied to the Wall Street Journal – when a story makes the front page of a widely-circulated newspaper or magazine, it signals widespread recognition of that story or theme. Since heavily-distributed newspapers and magazines tend to reflect the widespread sentiment of its readers and the general population, a front-page headline signals the acceptance of that idea as consensus.

It’s been a fairly long-standing negative omen for the market when major cover stories marvel at the wondrous bull-market run-ups and, inversely, a positive omen for the market when cover stories mourn the death of markets. That said, positive cover stories regarding investment themes are bad omens, signaling an upcoming pause or correction, if not an end to that theme.

If mass mood in this case is extreme optimism regarding gold, it may be nearing the end of its run. At the very least, the TV series and heavy media attention signal that the "mania Phase" is underway.

"We Buy Gold" Everywhere

In the past two years, there have been more "sell your gold" commercials and "we buy gold" stores than ever before – not to mention all the gold and silver ads located all over the internet. It seems as if everywhere I go or look I see some kind of reference to gold. The prevalence of these stores and commercials not only points to market saturation, but also points to the massive spotlight that has been shining on gold.

4. Extreme Speculation

a. The introduction of gold ETFs, and the ease with which the average investor can now invest in gold, has made gold much more accessible – and, in turn, much more speculative than ever before.

b. No hedging by the mining companies at the exact time when protecting themselves from declining prices is most important. In order to protect their businesses from a sudden decline in Gold prices, mining companies have generally hedged themselves by owning some put options or other forms of derivatives that would limit their losses in case of such declines. And the higher the price of gold, the more dangerous the price decline is for the miners. But because most of the miners think that gold prices are going to continue rising, they have recently stopped hedging themselves. At a time when protection is actually the most important in the history of their businesses, they’ve joined the gold craze and ceased to hedge. This is as counter-intuitive as it gets: hedges are protections "just in case" prices go down; miners seem to have forgotten that "just in case" is a small bet compared to the potential devastation they may be setting themselves up for.

c. Gold vending machines! It wasn’t enough for gold to be bought at jewelry stores or through distributors directly. They have now built vending machines from which to buy gold!

d. Gold is not enough. First, investors flocked to gold through the GLD ETF. Then, they jumped into the gold miners ETF (NYSEARCA:GDX) for higher returns. Then they dove into the junior miners (NYSEARCA:GDXJ). The further down the line investors go, the higher the speculation and, in turn, risk.

But the gold and gold miners weren’t enough, so investors have moved on to other derivative plays on gold – silver (NYSEARCA:SLV), palladium (NYSEMKT:PAL), platinum (NYSEARCA:PPLT), copper (NYSEARCA:JJC), rare earth elements (NYSEMKT:REE), Molycorp (MCP), and the GLTR ETF, just to name a few. These moves by investors are not only evidence of the extreme belief that gold prices will continue to rise, but are also signs of massive risk-taking and a potential expansion of the gold bubble, as investors flock to these stocks and ETFs simply due to the fact that they are related to gold.

And if my opinion isn’t enough to convince you, maybe the CEO of Molycorpcalling the rare-earth play a bubble will.

5. Lack of Traditional Investment Valuations ("It’s Different This Time")

A major characteristic of speculative bubbles is the lack of ways to correctly value the underlying asset. Many bubbles, such as the technology bubble of the late 1990s, develop and grow due to giant expectations of the future success or appreciation of the often-misunderstood asset.

"So it is natural to expect that an information cascade is especially likely to develop in response to a genuinely new and different investment opportunity, one that is completely outside the realm of most investors’ personal experience. And this is exactly what is happening when we hear talk about new industries and new technologies that promise to revolutionize the economy (ibid. 48)."

With the tech bubble, investors thought the internet was the future and their investments would only keep rising in value:

Spurred on by the growing use of the internet and the speculation that this new technology was the wave of the future, stock prices soared as investors piled into internet-based companies, sometimes simply for the fact that they included an "e-" prefix or ".com" ending to their names. And though investors were correct in assuming that the internet and technology were the future of business, the exorbitant prices they were willing to pay for companies that hadn’t even turned in a profit should have stood as a stark warning.But what could investors have done? The internet was rapidly gaining popularity, stock prices were soaring, and the argument that this was a "new age," where old valuation measures no longer applied, was becoming the norm. Things were "different this time," and you’d be crazy not to join the party.Yet while investors were correct in asserting that the internet and technology were to be the wave of the future, their expectations got a little ahead of themselves, and their blind-faith in almost any company in the technology space was unwarranted. If you joined the party too late, you would have lost almost everything.

Similar to the technology bubble, gold also involves an asset that is hard to truly value. It has been the main source of wealth for thousands of years and throughout the globe, yet it is hard to determine what it’s truly worth. Its value is affected by inflation, deflation, war, economic crisis, etc. – factors that are nearly impossible to evaluate or determine with certainty. Instead, gold prices have been highly influenced by speculation about upcoming world events, as well as uncertainty and fear. Human psychology and its extreme opposition to fear make gold almost a perfect candidate for a bubble that preys on emotion:

"Affirmative messages that build crowd unity are not usually appeals to the intellect of crowd members. Instead they are appeals to emotion, to stereotypes, to dreams or fears. The language of persuasion and crowd solidarity is the language of drama, not science (ibid. 56)."

"It’s Different This Time.” As in most bubbles and overly-euphoric investor behavior, the argument that this time things are different has surfaced once again. In the "dot com" bubble the argument was that the "new age of technology and the Internet" was here. In the housing bubble, land values were going to continue to soar because land was only to continue to be scarce as population grew and people needed homes; the extravagant prices were seen as a result of "new valuations" for homes. Now, gold’s value is considered to be "different this time" because global markets are interconnected, economies are at high risk, and currency systems are seen as highly unstable. But are things really so different now?

Rapid price run-ups tend to diverge from the underlying fundamental reasons for their move. In other words, as people start getting overly excited about a certain investment theme they actually run the price up too far, too fast. Their reasons for excitement may be accurate, but their excitement and the extent to which prices run up are actually getting ahead of themselves. Prices can’t go up forever, and they eventually start to drop. And as more and more people start to realize this, prices plummet faster than before. This marks the bursting of the bubble that will eventually see prices crash and many people worse off than before. And if gold is the current bubble, this fate awaits many people now investing in gold.

6. Faulty Historical Comparison

The often-used argument by gold bugs has been that the gold price, if adjusted for inflation, is still considerably below the highs of the early 1980s. And since we are still below the early 1980s prices, we should not be concerned about a gold bubble. Even more, the argument claims that since we are well below inflation-adjusted record prices in gold, we can expect gold prices to continue to run up significantly before a peak is in place. In other words, they claim that $1400 gold is still not expensive because $1400 in 2010 is worth less than $700 in the early 1980s.

I have a few issues with those claims though:

1) Gold price records of 1980 came at a time of soaring inflation. Inflation was at 13.5 percent in 1980! Compare that to 2009 where we had negative inflation, and to 2010 and 2011 where we’re averaging nowhere near 13.5 percent as in 1980. Since inflation "inflates" prices, it is understandable how gold prices skyrocketed in the early 80s in order to reflect the surge in overall prices. But at a time when inflation is far from soaring (at least in comparison to the early 1980s), much of the speculation in gold today is due to uncertainty and fears about the future, rather than the reality that supported gold’s rise in the 1980s.

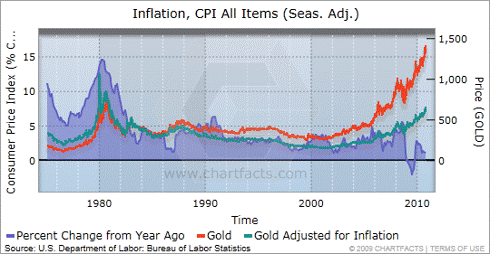

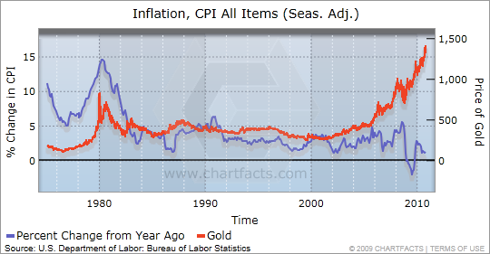

Take a look at the chart:

As you can see, the 1980 gold price high was accompanied by huge percentage increases in the CPI. And over the next 25 years, gold prices were generally stable as the CPI grew between 1 and 6 percent annually. But starting in 2005, we all of a sudden have a huge divergence between gold prices and the CPI. In other words, we would expect gold prices to rise and fall in accordance with changes in the CPI – if the CPI soars we would expect gold prices to rise as well, and if the CPI falls we would expect gold prices to fall or at least grow modestly. But that’s not the case here; the gold price surged together with CPI in 1980, but is completely diverging from CPI since 2005. If anything, we should be seeing gold prices stagnate or even drop a little to match the lower inflation.

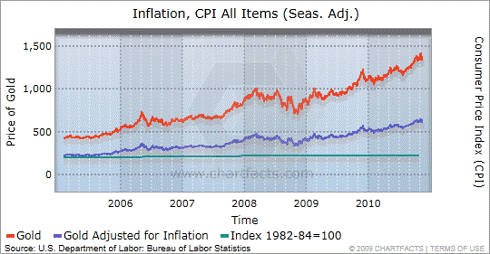

2) Largest divergence between real gold prices and inflation-adjusted gold prices. Not only are gold prices diverging from the yearly CPI changes, but they are also diverging from themselves.

Take a look at the chart:

While real gold prices and gold prices adjusted for inflation have generally remained close, they have diverged from each other to a huge extent since 2005. In the early 1980s, the two prices were almost identical, and even overlapped. But in 2010, we had real prices at $1400 while the inflation-adjusted price of $644 lagged by over 50 percent. Either the inflation-adjusted price has to catch up, or the $1400 real gold price has to drop. With such a massive and unprecedented divergence between the two, I’d bet on option B.

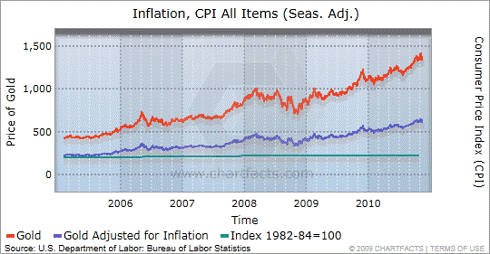

3) As CPI is up less than 30 percent since 2000, gold is up over 350 percent. If CPI is a good measure of overall inflation, we’d expect prices of most items to increase, or decrease, in accordance with changes in the CPI. Therefore, if the CPI increases by 30 percent, we’d expect most items to increase in a range around that 30 percent; prices of food may rise 35 percent, but prices of energy could rise only 25 percent, for example. But when we see the price of one item increase by 350 percent, as gold has in this case, we should question whether such a move is really justified as prices of the rest of the things we could buy are not even close to moving that rapidly.

Take a look at the chart:

As CPI has essentially flat-lined since 2005, gold is up almost threefold.

4) Price highs from the 1980s stand as strong resistance against much higher prices. Since gold lacks intrinsic value, unlike stocks, and relies mainly on supply and demand, previous high prices play an even greater role. In our case, the inflation-adjusted price highs of the 1980s (between $1700 and $2400) could present heavy selling pressure, as investors reconsider their gold investments as prices near previous all-time highs. And the chances of approaching the $2000 level are probably slim anyways if inflation has anything to do with it, since we are nowhere near inflation levels of that period.

In conclusion, though we have not surpassed the record high price of gold in 1980 when we adjust for inflation, we have certainly doubled the record in real prices, we currently have no soaring inflation that would justify the huge price moves (as it did in 1980), and we have the largest divergence ever between real prices and inflation-adjusted prices. In other words, gold is moving much faster than inflation, and maybe even too fast.

7. Intolerance of Opposing Views

"I have found a crowd’s intolerance of contrary views to be its single most important identifying characteristic. This intolerance shows itself in the form of ridicule and abuse of any skeptical consideration of its theme (ibid. 56)."

One of the strongest signs of herd mentality is the fear of taking the opposite view. So far, I am yet to see strong opinions in opposition to gold – someone who puts their money where their mouth is. And when I do see someone claiming gold to be a bubble, their claims are met with heavy opposition and ridicule. This ridicule and scorn (visible in the comment sections of many anti-gold articles) are undoubtedly signs of intense bias and strong emotional ties to the gold theme; and breaking from these biases or emotions is extremely hard to do – especially when one’s money is invested in what is being argued against.

We therefore can understand why gold-bubble claims are met with heavy opposition – because those invested in gold have a high interest in continued price increases. But when the ridicule becomes so one-sided and intense, especially when it’s backed by faulty logic or extreme expectations, signs of a crowd and speculation emerge. Strong and vehement opposition to anti-gold individuals is therefore substantial proof that the gold bubble is nearing saturation.

8. Herd-like Price Targets

"In the late stages of a crowd’s life cycle, virtually all of the content will be devoted to methods for exploiting the market’s projected movements, not to explanations of why these movements should occur at all (ibid. 121)."

Gold Price Targets Range From $1,000 to $15,000: Who is Right?

Virtually no one is willing to bet against gold. Even among those who think gold is a bubble or risky investment, there are very few, if any, people actually willing to bet against it. Though it’s generally a very smart move to avoid betting against a stock or investment theme with a lot of momentum behind it, the fact that even gold bears are shying away from betting against it may signal that it is a bubble with extremely high bullish sentiment. If the gold bears are even afraid to bet against it, is there really much room left for gold to run? What happens if these gold bears finally gather the courage to start betting against it?

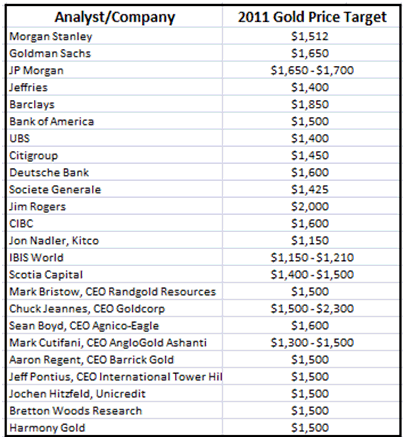

Moreover, if we look at the huge number of price-target estimates made by institutions, investment professionals, analysts, and the gold mining companies themselves – only 2 out of over 100 estimates are below $1400! And most of them are far beyond the price today. Such extreme bullishness should be met with severe cautious at the very least. The lack of dissenting opinion is highly unsettling.

But - I could be wrong. At least that's what almost every analyst, bank, mining company, investor,and financial institution thinks. Gold price targets for 2011 range from anywhere near $1000 to as high as $15,000. The larger financial institutions are clustered near $1,500 though. And considering Gold is currently selling at around $1430, does it really pay to take on the potentially large risk when consensus estimates are only about $70 away? If you do think it is worth it, youshould hope some of the individuals predicting$2,000 or $15,000 goldare right.

Here is a comprehensive and exhaustive list of Gold price projections:

From GoldinMind.com:

Higher than $10,000

$5,000 – $10,000

8. David Petch; $6,000 – $10,000;

11. Peter Schiff: $5,000 – $10,000 (in 5 to 10 years);

Gold-forecast: Jim-Rogers-Peter-Schiff-or-Roubini

Gold-forecast: Jim-Rogers-Peter-Schiff-or-Roubini

$5,000

Up to $5,000

< $3,000 – $4,000

$2,500 – $3,000

Source: Goldmine.com.

Additional Risks:

1. Emerging Market Troubles

One of the major drivers of the markets over the past two years has been the "unstoppable" and highly promising future of the emerging markets -- especially China. As millions of inhabitants in emerging countries begin to enter the "modern" world and middle class, their consumption and their effect on the economies of countries all over the globe increases. And as millions of people contribute to the growth of China, India, and other countries, they will require extra food, energy sources such as gasoline and oil, cotton for their increased consumption and clothing needs, industrial metals for their new cars and technology, and many other materials that a growing and evolving population needs.

The problem that may emerge, however, is that there is no guarantee that China and other emerging countries will actually meet our lofty expectations. Emerging markets have been growing at such a rapid pace (7-10+ percent compared to 2-3 percent for the U.S.) that their development may actually be setting them up for housing bubbles, high inflation, and uncontrollable growth.

The problem -- and it's a major one -- with this emerging markets theme that has dominated for the past two years is that all the expectations and projections investors have had may be way too optimistic. With China and others showing very troubling weakness and attempting to slow their growth in order to prevent economic turmoil, a huge economic dip is not out of the question. Add to that the possibility that all the growth is already factored into the commodity and stock prices (that investors have speculated tremendously in all EEM-related themes and that the current prices reflect future expectations), and any stumble or slower growth could send prices plummeting as they attempt to adjust to more realistic growth.

Here is the possible scenario that derails economic recovery and hurts emerging markets investors:

- Emerging markets have been set up with lofty expectations for growth that will not be achieved due to unsustainable commodity and food prices, as well as unsustainable growth rates.

- The double-digit growth rates that many investors have been relying on do not actually materialize. More reasonable growth rates of 5-8 percent do.

- Since prices have run up at such massive rates and steep angles, they must come back down to reflect the more reasonable growth rates that have surfaced.

- Prices for emerging markets, commodities, food, and energy drop considerably in order to better reflect current conditions and revised future expectations.

If emerging markets continue to show weakness, commodity prices could suffer. And if commodity prices suffer, gold will most likely drop as well.

2. Monetary Tightening/Interest and Margin Rate Risks

If emerging countries and others begin tightening what has been very loose monetary policy since the recession, commodity prices may suffer. With high and unsustainable inflation emerging in many countries – from China to the UK – increasing interest rates or margins in order to combat these threats could put a sharp stop to gold and commodity prices. Furthermore, though it may be far off, U.S. tightening could put a big damper on further price increases.

3. Inflation or Deflation?

Investors have bought gold out of fear of both inflation and deflation – one of the two must be wrong.

4. Market Up Means Gold Down

I am not yet convinced that the market will continue its uptrend and recovery. But those gold lovers out there must keep in mind that much of gold’s run has been due to the uncertainty and the continued threat of a renewed recession or global turmoil. If the market continues to rise and the economy continues to improve, many investors will move back into stocks instead of gold; much of the incentive to invest in gold will no longer exist. According to this argument, only a market decline should justify buying gold. On the other hand, rapid inflation could justify rising gold prices too. It appears that gold will benefit only from a renewed recession or rapid inflation; anything in the middle supports gold’s decline. A recession or inflation isn’t out of the picture though.

5. Gold Price and Gold Miners Lagging

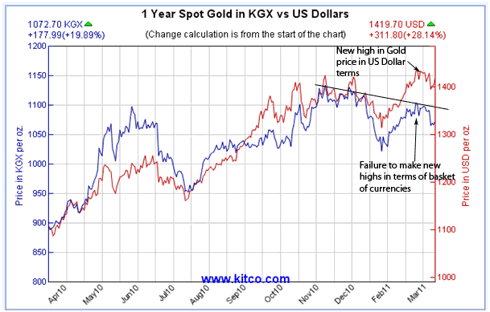

Gold has set new highs in U.S. dollar terms, but is lagging both in terms of other currencies and in the share price of gold miners.

According to Kitco's index, Gold is yet to make new highs in unanimous fashion; it is still lagging in terms of other currencies. And unless it can break out to new levels in a decisive way, we may currently be approaching the next phase down.

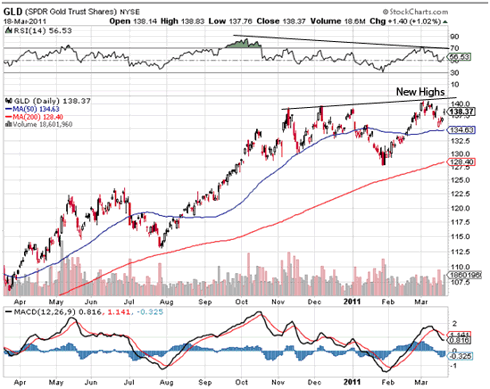

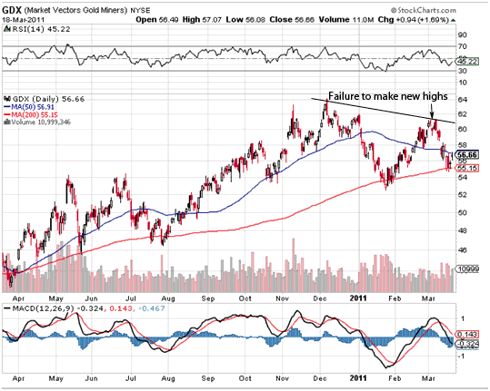

While gold has recovered all of its losses and even broken out to new highs (at least in U.S. dollar terms), the miners have failed to do so, and have even dipped for the second time since attempting the recovery.

6. Still a Safe Haven?

Gold is even starting to show weakness as a "safe-haven" play, as prices have not responded well to the Middle East and Japan turmoil.Though gold and silver are expected to gain if the market drops, as investors flee to safety, we're not so sure if these precious metals are truly as "safe" as many believe them to be. If gold and silver have become speculative trades, as we think they have, they may drop together with the rest of the market (as did oil in 2008, when everyone believed it would continue to soar).

Conclusion

For all the reasons above, we think the risks involved in gold are too great to warrant investing in it. Not only have we seen soaring prices, media frenzy, overly enthusiastic investors, extreme speculation, and what appears to be an overly-saturated investment theme; we are now seeing weakness, as gold has underperformed silver and many commodities over the past few months and has even lost some of its strength as a "safe-haven" play during the Middle East and Japan turmoil. Furthermore, we think there are other investment opportunities that provide better value and further upside for much less risk (diamond-related plays or natural gas, for example).

We continue to hold the opinion that gold looks extremely dangerous at these levels, against what seems to be the entire investing world. With so many clues pointing to the near-definite gold bubble, accompanied by extremely optimistic investor sentiment generally seen in previous bubbles, we are short gold mining companies and awaiting further confirmation to pile on the short-gold trade.

"When everyone thinks alike, everyone is likely to be wrong" – Neill (1954)

Sometimes it pays to go against the crowd.

No comments:

Post a Comment