Bank of America has underperformed for a number of years in an already-shaky banking sector, with added uncertainty regarding interest rates, economic growth, lending, income generation, and regulation. But the worst is now likely behind BofA (BAC), and investors could begin to warm up to and even chase the stock due to very attractive and deeply-discounted valuations, strong cash flows, a growing dividend, increasing earnings, peer outperformance, and an improving overall environment.

After collapsing during the financial crisis of the Great Recession (2007-2009), Bank of America (BAC) has been stagnant during the economic recovery which followed. Though the stock bottomed in early 2009 and again in late 2011, it has done almost nothing for three years since 2013.

Bank of America (BAC) has underperformed the broad Financials sector (XLF).

BAC is significantly lagging Since the 2007 peak:

BAC is significantly lagging since the the beginning of 2010, with a negative return while Financials (XLF) as a whole are up big:

Now is the time to BUY Bank of America (BAC), and here's why:

VALUATIONS

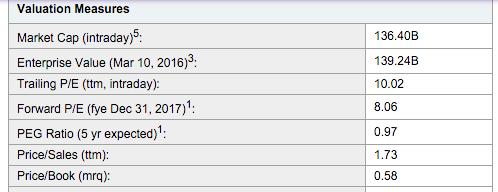

Bank of America is trading at very attractive valuations, selling at a deep discount likely due to overblown fears.

The stock is currently trading at a Price-to-Earnings ratio (P/E) of 10 and a forward P/E of 8. Moreover, the P/E ratio has dropped considerably to a low not seen since 2012:

Furthermore, the stock is selling at nearly HALF its Book Value (P/B) and even below its Tangible Book Value (P/TB):

Most Bank stocks have been selling at discounts to Book Value or close because of all of the fear surrounding the sector. But with much of the Financial Crisis and potential hurdles behind us, buying BAC at around half of BV is a steal.

FINANCIAL STRENGTH

Bank of America is fairly solid financially and in many ways stronger now than it was before the Great Recession.

BAC's liquidity and ability to withstand a slowdown is visible in its Cash Ratio and Quick Ratio:

BAC also has a greater ability to cover its Debts, visible in its much lower Debt-to-Equity (Debt/Equity) and Debt-to-Assets (Debt/Assets) ratios:

BAC also has a greater ability to cover its Debts, visible in its much lower Debt-to-Equity (Debt/Equity) and Debt-to-Assets (Debt/Assets) ratios:PROFITABILITY

Bank of America has improved on both its Earnings and its Margins.

It has been able to grow its Earnings Per Share (EPS):

Margins (Profit Margin & Operating Margin) are positive and also improving:

Net Income (NI) is positive and has been on the rise:

Net Income (NI) by business segment:

CASH FLOWS

Bank of America's cash flows are pointing to a safer, more liquid, and growing company. Usually considered one of the most important determinants of a financially-strong company (or, in the opposite case, an accounting "red flag"), Cash Flow for BAC is mostly a positive factor.

Free Cash Flow (FCF) is positive. Though it has been volatile, it still looks good:

BAC's Operating Cash Flow (CFO) is positive. Another major "red flag" in the case of negative CFO, Bank of America still has the "green light" because its CFO is positive.

BAC's Cash Flows from Operations (CFO), Investing (CFI), and Financing (CFF). Financing has turned negative, but overall Cash Flows are acceptable.

Cash Flows are important because they can indicate a company's ability and liquidity to weather a slowdown or cover its debts, as seen in BAC's Cash Flow from Operations (CFO) to Current Liabilities ratio:

DIVIDEND

Another good reason to own BAC is the Dividend that pays investors an income stream while they wait. Even better, though the current 1.51% Dividend is still low, it has been growing:

Additionally, as Banks continue to strengthen and overcome the strict regulation which has limited their ability to raise dividends, BAC's dividend might approach its historical level of closer to 4 or 5%:

INSIDER BUYING

Insiders still own only a tiny piece of BAC stock, but their support has grown, as visible in the growing number of shares owned by insiders:

PEER COMPARISON

Bank of America is also attractive when compared to its competitors, not just on an absolute basis.

When compared to companies like Citigroup (C), JP Morgan (JPM), Wells Fargo (WFC), US Bancorp (USB), American Express (AXP) and Goldman Sachs (GS), Bank of America (BAC) has a very attractive P/E Ratio, PEG Ratio, P/S Ratio, and P/B Ratio. In fact, its Price-to-Book (P/B) ratio is the lowest of its major competitors, and far below most of them.

BAC has far more Cash and Short-Term Investments ($167 Billion) than all of its competitors except for JP Morgan:

BAC has strong Revenues and competitive Net Income when compared to the other banks:

BAC has strong liquidity and Free Cash Flow compared to its peers:

BAC has room to grow its Dividend:

Even with the attractive valuations, strong financials, improving business, etc., Bank of America (BAC) has still underperformed most of the Financials Sector over the past two years:

Surprisingly though, since the March 2009 bottom the worst performers have been Goldman Sachs (GS) and Warren Buffett's Berkshire Hathaway (BRK.B):

Bank of America (BAC) is, however, the 4th largest allocation within the Financials ETF (XLF):

TECHNICALS

Bank of America (BAC) has recently seen a sharp drop from ~$18 to $11, with a break below the critical $15 level. The $15 level dates back to 2013, so rising back above it could be difficult but is necessary for the continuation of the uptrend.

On the positive side, even with the overhead resistance, the Relative Strength Indicator (RSI) is trending up and even hinted at a bottom in February with a "positive divergence" in RSI while the stock price made new lows:

Furthermore, the Weekly chart looks excellent as the 50, 200, and 300-week Moving Averages are aligned properly and shorter-term momentum is leading. This Weekly chart will look even better, way better, if BAC can climb back above the 200-week MA.

Perhaps the rolling 52-Week-Highs and Lows could signal upcoming trend as well:

It is a bit disconcerting that the 52-Week-Low (red line) was violated and is trending down, but if BAC could break back above the $18.48, 52-Week-High (orange line), there is A LOT of upside.

REPUTATION

Bank of America is still one of the biggest and most well-known banks, with a great reputation and plenty of awards. There is plenty of room for improvement, but the brand name is a huge plus.

Nothing is guaranteed, but think about it this way: If there is another banking or financial crisis, which bank is the US Government most likely to save solely due to its name?

It also helps to have a leading Wealth Management brand name like Merrill Lynch:

It is selling at steep discounts; it sports attractive valuations; it has improved its financial strength substantially; it is profitable; it is growing; it has good cash flows; it has growing insider support; it has strong peer comparisons; it pays a dividend; it has a great brand name; and it has plenty of room to exceed expectations.

Bank of America (BAC) may be the best Bank stock to invest in, and it could double, triple, or more over the next years if it can continue to improve.

Includes: BAC, XLF, JPM, C, GS, USB, BRK.B, WFC, AIG