http://seekingalpha.com/article/239445-forget-gold-buy-diamonds

As investors, speculators, governments, and funds have piled into gold and other precious metals, they seem to have forgotten about the most valuable asset in the world – the diamond. Symbolizing wealth, quality, and love for centuries, the diamond shares many similarities to gold. Yet, while gold prices have surged nearly 500 percent in 10 years, the prices of diamonds are nearly flat. And though gold offers better use as a store of value and currency hedge, diamonds may begin to catch up as global demand increases and the gold/diamond ratio returns to its historical average.

I am not arguing with the underlying reasons that make gold attractive. Gold’s inherent value is understandable. As I mentioned in a previous article (“Gold Bubble: Final Warning?”), the rapid price increase in gold over the past few years is due to mounting fears over currency, poor investment alternatives, and the lack of stability in just about anything else.

What I am at odds with, however, is the justification of gold’s current price. Sure, demand has increased, uncertainty continues, and the threat of financial collapse still lingers over our heads. But at what point have we sacrificed our rational thinking by skyrocketing gold prices just to own a “tangible” asset? Believing that gold will “always retain its value” is a complete misconception – yes, gold will always be valuable; but its actual value relies on how much people are willing to pay for it. Gold would still be valuable at $800 an ounce. But if you buy it at $1400 and the price drops to $800 because people start to realize they have become a little too exuberant, you still lose a lot of money.

But even if you think gold is going higher -

7 Reasons Why Diamonds Are a Good Investment:

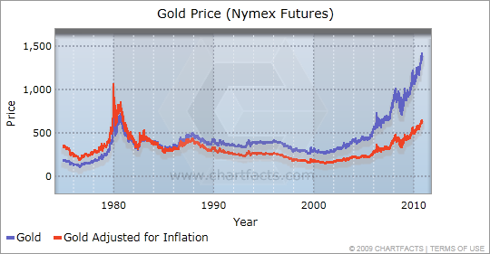

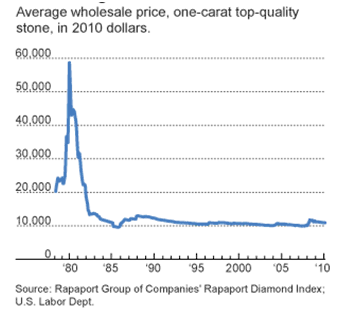

1) Diamond/Gold Price Disparity. While gold is up nearly 500 percent in 10 years, has surpassed its all-time record price of around $800 in 1980, and is nearing its inflation-adjusted record price (also in 1980), diamond prices have almost completely flat-lined since the early 80s.

Take a look at the charts:

click to enlarge

As you can see, both gold and diamond prices surged in the early 80s. But while gold prices have increased tremendously since 2000, diamond prices have lagged heavily.

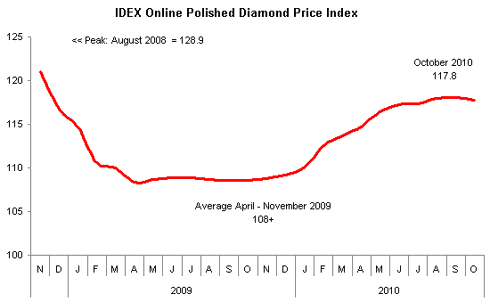

If we compare gold and diamond prices over the past two years, it is even more apparent:

While the gold ETF (NYSEARCA:GLD) is up over 80 percent in the past two years, diamond prices based on the IDEX Diamond Price Index are actually down about 3 percent in the same period. With such a wide disparity in price movements between the two precious assets, it may be time to buy the lagging diamond – unless you think gold no longer listens to history and will stay far ahead of diamonds. History usually wins.

2) Diamonds have Industrial use. Having the highest hardness and heat conductivity of any bulk material, diamonds possess tremendous value for industrial use. Able to polish or cut any material among other uses, diamonds are used in saws, abrasives, construction, computer chip production, lasers, surgical equipment, and, ironically, mining. In fact, 80 percent of mined diamonds are actually used industrially. With such a staggering percentage used as non-jewelry and non-investment, the value of diamonds is even more apparent. It is not just valued based on jewelry demand or diamond speculation; it actually serves important industrial purpose.

3) Necessary for Global Growth. With emerging countries growing rapidly, large infrastructure development is necessary. Roads and highways have to be built, cities must be able to expand, and the required tools must be bought. And since diamonds are utilized in many tools used for stone cutting, highway building, and other technologies, demand for diamonds should increase alongside global growth. Therefore, if emerging economies continue to grow, we can expect diamond usage to grow as well. And if demand grows, prices will likely follow.

4) Developing Nation Wealth Will Increase Demand. Similar to reason #3, as developing nations and emerging economies grow, demand for diamonds will increase. Yet, while reason #3 stresses the industrial usage and demand for diamonds due to global growth, this one focuses on the individuals within these countries.

As emerging countries grow, their population will become wealthier. And as the individuals become wealthier, they will increase demand for diamonds because they will then be able to afford them. If there are many more people demanding diamonds across the globe, you can expect prices to rise.

5) Highest Value per Unit Weight. Diamonds are the most valuable items in the world. A handful of diamonds could make you a multi-millionaire. That said, diamonds are the best “portable emergency disaster fund” available. What I mean by that is that diamonds are the lightest and easiest way to store wealth in case of emergency. Stories have been told about people who had to flee their homes and were able to take their precious gems with them as portable wealth. Not that people will have to evacuate their homes and take all of their belongings with them any time soon; but if people are buying gold because it’s the best store of value in case of emergency, would you rather carry a diamond or a bunch of gold blocks?

6) If the Consumer is Stronger, Demand is Higher. If you believe that the economy is recovering, you could expect consumers to recover as well. Consumer confidence has actually improved recently. If that trend continues, you could expect disposable income and spending to increase as well. And if consumers have more to spend, and actually do spend more, you could expect them to buy more jewelry and more diamonds. Add to that some stronger holiday shopping, and diamond demand increases.

7) Diamonds Have Emotional Value. The value of diamond jewelry given as gifts is greatly increased by the emotional component involved. Engagement rings, anniversary gifts, and Valentine’s Day presents are just a few examples of how the value of an already-valuable item is exponentially increased. As long as men want to make their women happy, diamonds will continue being valuable assets.

3 Ways to Play This:

1) Sell Gold, Buy Diamond Retailers. There is currently no diamond ETF or fund, but a good bet on diamonds is either through diamond miners or diamond retailers. If diamond prices start catching up to gold, or if gold prices begin to drop to more sustainable levels, we can expect companies involved in diamond exploration or retailing to outperform gold and gold miners.

Therefore, a good pair trade would be to Sell Gold through the Gold ETF (GLD) or through the Gold Miners ETF (NYSEARCA:GDX) and to Buy diamond retailers such as Zales (NYSE:ZLC), Blue Nile (NASDAQ:NILE), or Tiffany (NYSE:TIF).

Take a look at the following chart, which compares the relative performances of the Gold ETF (GLD) and Gold Miners ETF (GDX) with the three diamond retailers mentioned above:

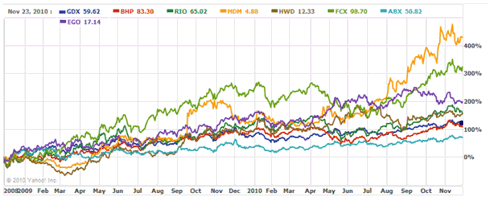

2) Sell Gold Miners, Buy Diamond Miners. If diamonds outperform gold, we can expect diamond miners to generally do better than gold miners. Therefore, you could Sell Gold Miners either through the Gold Miners ETF (GDX) or the Junior Gold Miners ETF (NYSEARCA:GDXJ), or by shorting individual mining companies such as Freeport-McMoran (NYSE:FCX), Barrick Gold (NYSE:ABX), or Eldorado Gold (NYSE:EGO). To pair that short sale, you could buy companies that mine diamonds exclusively such as Mountain Province Diamonds (NASDAQ:MDM) and Harry Winston Diamond Corp. (HWD).

Here is how those have performed over the past two years:

3) Sell Gold Miners, Buy “Multi-Purpose” Miners. If you want the best of both worlds, you could Sell the Gold Miners ETF (GDX) or the individual miners (see above) and buy Rio Tinto (NYSE:RIO), which mines a wide array of minerals such as aluminum, copper, gold, silver, and diamonds, or BHP (NYSE:BHP) which has its hand in everything from metals to diamonds to potash to crude oil to coal.

Diamonds have been the most valuable assets for centuries, and have generally moved together with gold. When gold prices surged in the early 80s, diamonds surged to record prices as well. But since 2000, gold prices have increased tremendously while diamond prices have been flat-lining. The price increase in gold is mainly due to increased demand, currency fear, inflation protection, and the need to hold onto a “stable,” “tangible” asset at a time when everything else seems to be in danger. Yet, while the underlying reasons for buying gold are definitely understandable, they don’t necessarily justify the exorbitantly high prices. Moreover, diamonds offer plenty of reasons as to why they should be rising alongside with, if not catching up to, gold: important industrial usage, highest value per unit of weight, necessary for global growth, and high emotional values. If the saying is really true that “a diamond is forever,” the time to buy diamonds may be now.

Disclosure: Short GLD, Long ZLC

No comments:

Post a Comment